In today’s fast-paced AI landscape, the fear of missing out (FOMO) often drives insurance carriers to make top-down decisions on implementing generative AI. According to recent industry surveys, over 60% of insurance carriers struggle with AI implementation, with data integration and security concerns being the top challenges. Many carriers rush to build and deploy autonomous AI agents, only to find themselves dealing with the same implementation pitfalls that often accompany complex technology rollouts.

For many insurance carriers, building AI agents in-house quickly turns into a maze of challenges involving retrieval augmented generation (RAG), vector databases, and advanced data pipelines. Carriers often underestimate the need for ongoing tuning and the critical role that data quality plays in ensuring AI delivers reliable, timely results. Not only do these architectures require specialized skills, but also significant resources for development, testing, and iteration—often taking months to achieve reliable accuracy.

These technical hurdles typically lead to:

Salesforce’s Agentforce and Data Cloud address these challenges head-on, offering a robust ecosystem that removes much of the complexity associated with deploying AI agents. Unlike a purely custom-built solution, Agentforce provides pre-built, well-supported models while also offering ‘bring your own model’ capabilities with Data Cloud, allowing carriers to leverage custom models where specialized needs or cost considerations are important.

Data Cloud serves as a powerful addition, aggregating and harmonizing data from disparate systems, enabling carriers to use real-time, high-quality data as the foundation for their AI agents. Additionally, Salesforce now incorporates the capabilities of a large vector database to accommodate unstructured data in the form of PDFs and call transcripts, which is critical as it is estimated that 80% of data is actually unstructured.

A critical aspect of deploying effective AI agents is ensuring that they are grounded in reliable company data. Salesforce Data Cloud plays a vital role here by aggregating data from various sources and maintaining high data quality standards. With Data Cloud, insurance carriers can ensure that their AI agents are always working with accurate, up-to-date, and well-governed information.

Data Cloud facilitates effective data governance by providing tools that help:

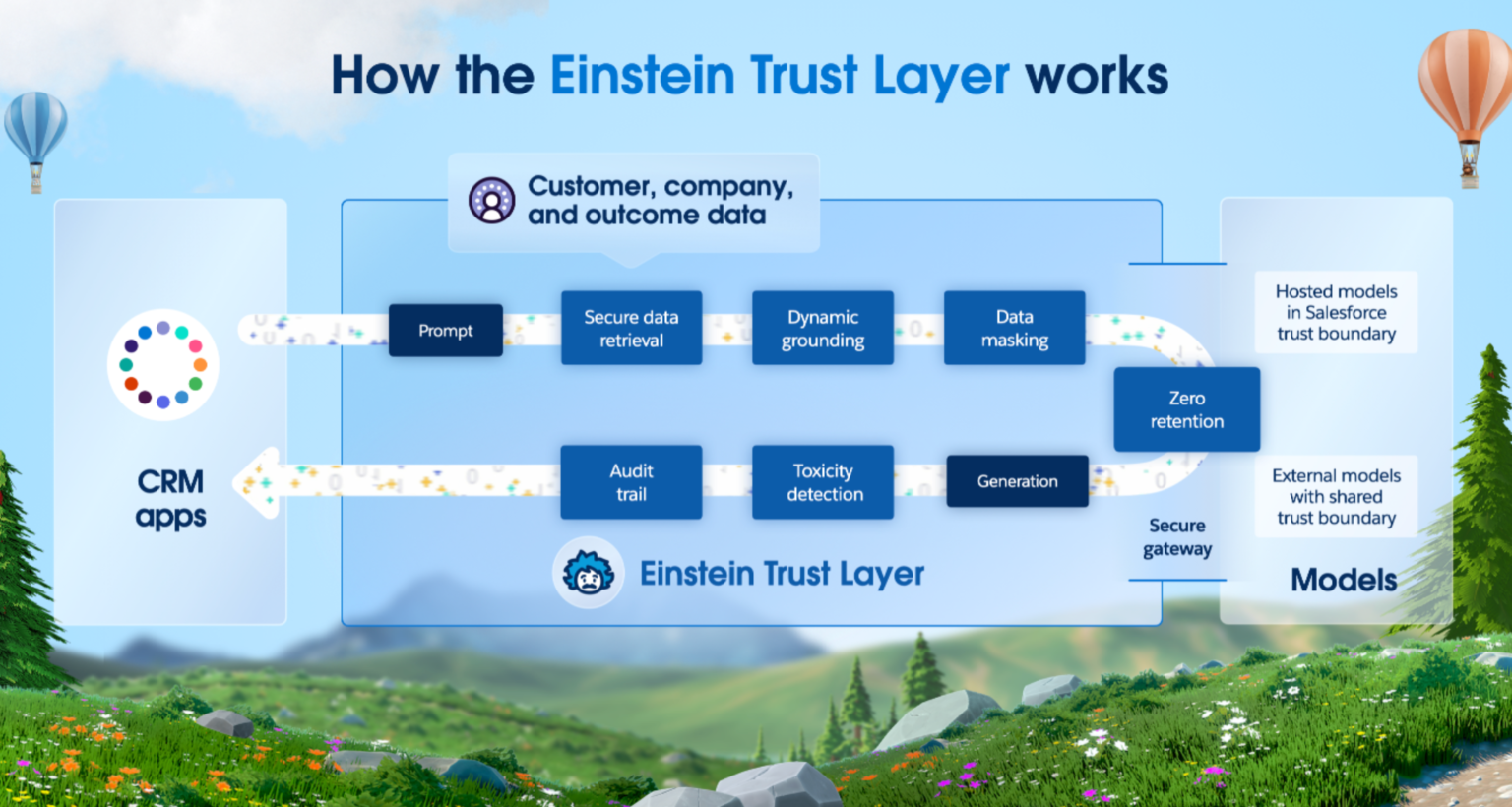

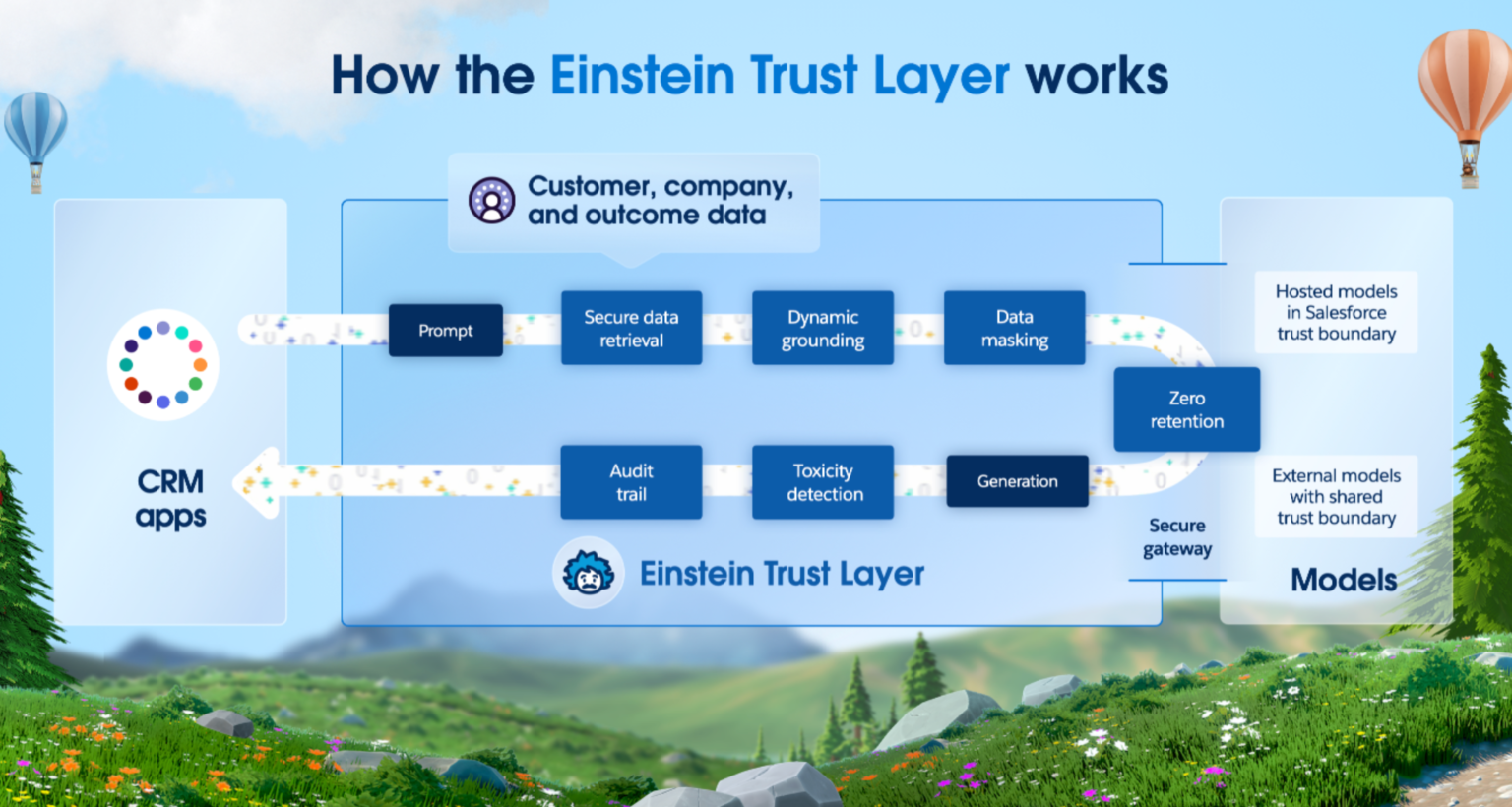

Security and safety are paramount when deploying autonomous AI agents, especially given the sensitive nature of insurance data. Salesforce’s Trust Layer offers a set of governance and security capabilities that work in tandem with Data Cloud to ensure that AI is implemented in a safe and compliant manner. The Trust Layer provides control over data access, ensuring that only authorized users and systems can interact with sensitive information.

Another challenge for insurance carriers building in-house is the lack of a structured, cross-functional approach. Salesforce provides a cohesive platform that fosters collaboration between teams, from business stakeholders to developers and data scientists. Tools like Agentforce are built with usability in mind, meaning that business leaders in the insurance space, without extensive AI expertise, can interact with AI-driven agents and understand their outputs.

The desire to innovate can lead to hastily made AI decisions—a typical consequence of FOMO. Salesforce Agentforce enables insurance carriers to take a more measured, tactical approach to AI agent deployment. With pre-built capabilities and clear governance tools, Agentforce reduces the barriers to entry, allowing carriers to experiment with AI in controlled scenarios before expanding into broader use cases.

To succeed with AI agents, insurance carriers need a roadmap that doesn’t end at deployment—it must include ongoing iteration, monitoring, and adjustments. Agentforce and Data Cloud are built with these long-term needs in mind, offering:

Insurance carriers stand at a pivotal moment in the evolution of AI. By utilizing Salesforce’s Agentforce, Data Cloud, and Trust Layer, carriers can confidently tackle the complexity of AI agent deployment, ensuring that their efforts are secure, data-driven, and aligned with business goals. This strategic approach allows carriers to innovate without falling into the common pitfalls of hastily made decisions driven by FOMO, ensuring a sustainable AI journey well into the future.

Don’t navigate the complexities of AI implementation alone. PS Advisory specializes in helping insurance carriers successfully implement and optimize Salesforce solutions like Agentforce and Data Cloud. Our team of insurance industry experts and certified Salesforce professionals can help you:

Book a meeting with our team and explore the steps to Successful AI Implementation in Insurance” and schedule a personalized consultation to discuss your specific needs.

PS Advisory can bring the strategies and domain expertise leveraged by LWCC to achieve an award-winning transformation to your organization. This includes insights and launching required capabilities that can revolutionize your insurance operations.

Gain exclusive insights into:

Don’t miss this opportunity to elevate your insurance business.

Fill out the form below, and we’ll personally reach out to share the details behind this award-winning project.

Your information is secure. We respect your privacy and will only use your details to discuss this exciting project with you.